This knowledge can assist in streamlining financial operations and reducing the risk of errors and anomalies. Furthermore, bookkeeping outsourcing is a cost-effective alternative that eliminates the need for an in-house accounting team and allows firms to pay for the services they demand. Ultimately, it can benefit your business by freeing up your time and ensuring your books are up to date.

How to choose bookkeeping services

SmartBooks not only takes care of the bookkeeping for small businesses but provides many other valuable financial services to help small businesses manage their accounts and financial health with ease. Overall, KPMG Sparks is a good all-in-one solution for small to medium-sized businesses looking for a simple outsourced accounting service. Pilot also offers in-depth tax services where outsourced bookkeeping services it can help your business with tax preparation, tax filing, 1099s, and others. You will get a dedicated tax preparer who will help you with all kinds of taxes applicable, and help you understand all the applicable taxes or your business. Depending on whether you follow cash-based accounting or accrual-based accounting for your business, there are different plans to choose from.

Outsource Bookkeeping: 6 Benefits, Types & Process

It’s best to create a pros and cons list of companies when outsourcing bookkeeping so you’ll know you’ve made the best choice. Ignite Spot is on the pricier end of the brands on this list, but what you get for the price is hard to argue against. Especially for teams that need the support but aren’t ready to hire a full-time accountant internally, Ignite Spot is a solid answer to the bookkeeping dilemma. Bookkeeping services are the foundational offering at Ignite Spot, but teams that need it (and have the budget to cover it) can upgrade all the way to CFO-level support from a certified public accountant (CPA). Would you rather tackle accounting yourself instead of outsourcing it to a third party?

Benefits of Virtual Accounting

Depending on the company, you can speak with your bookkeeper (or team of bookkeepers) as often as you’d like or at least a few times per month. Remote access to a team of bookkeepers means business owners have access to a team of experts who can help their business run more efficiently and make more money. In addition, by outsourcing your bookkeeping services, you’ll free up time and resources to focus on growing your business.

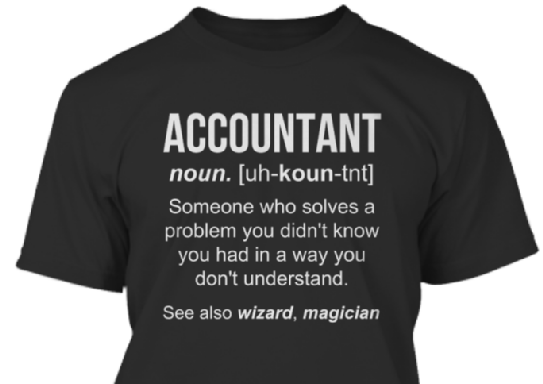

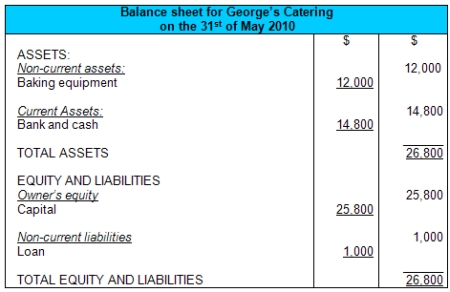

- Most other virtual bookkeeping services give you basic financial reports only, like income statements and balance sheets.

- Bookkeeper.com manages your accounts using QuickBooks Online (or QuickBooks Desktop, if you prefer).

- With most outsourced accounting service providers, you will be assigned a dedicated bookkeeper.

- As you grow, having a professional, outsourced accountant on your side gives you the advantage of proactivity rather than reactivity.

- Outsourced bookkeeping is affordable for many businesses, but the exact costs will vary based on several factors.

- When deciding on which solution works best for your firm’s bookkeeping, remember that there isn’t a one-size-fits-all solution.

Ignite Spot Accounting delivers heftier reports than many other cloud accounting providers we checked out for this piece. Along with typical financial reporting (like profit and loss reports and balance sheets), you’ll get a KPI (key performance indicator) report and profitability analysis, among others. You have to enter more information about your needs to get a quote—which is useful if you want truly customized services but unhelpful if you’d rather choose a basic plan out of a lineup. But Merritt Bookkeeping’s most stand-out feature might be its in-depth financial reports.

Ready for a streamlined accounting experience?

In addition, virtual bookkeeping services are often very comparable to those of in-house accountants. The main difference is that the virtual accountant will likely work from a remote location https://www.bookstime.com/ and use cloud-based software to have access to your financial records. This allows for round-the-clock support and eliminates the need for you to worry about losing any important data.

Plus, having an outsourced bookkeeper is more cost-efficient in the first place, since you’re not technically their employer. Plus, full-time bookkeepers are experts in the field that can generate more thorough reports and documents that take some pressure off your back once tax season hits. Bookkeepers use an accounting journal or an online accounting program to keep track of each transaction and the purpose of the transaction. Bookkeepers also handle payroll and payroll taxes, send invoices, handle accounts payable and keep track of overdue accounts. Without a great bookkeeper, your company could be losing thousands of dollars each period.

When you hire a bookkeeping team, you’re giving up some credit control and stock control. For example, you won’t have instant access to updates or information – instead, you’ll need to schedule calls or meetings. This means that communication is key, and it’s important to ensure that your bookkeepers are keeping you in the loop regularly. However, the benefits of having an external team far outweigh this downside. Having all of your bookkeeping together throughout the year will make tax season much easier.

- Their expertise in tax matters not only simplifies the process but also ensures compliance and accuracy, potentially leading to cost savings and a smoother tax filing experience.

- If you’re spending a lot of time doing HR and payroll manually, try Gusto.

- Every inDinero plan includes a dedicated account manager, direct employee reimbursements, some inventory management, and payroll assistance.

- Some of these services include forecasting and planning, management reporting, board presentations, financial analysis, strategic analysis, and others.

- When you outsource, you pay only for the services you need, which can be less expensive than a full-time bookkeeper’s salary and benefits.

Step 5 – Let the Bookkeeper Do the Bookkeeping

As an innovation hub, Austin leads in adopting new practices and technologies for better service. Learn how outsourcing leverages these trends in the evolving call center industry. How-to guides, tips and actionable advice on how to manage your BPO team like a pro.